Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ

By Patti Arthur, EAA 796527

June 2016 - The IRS has reduced the application fee for Code Sec. 501(c) exemption requests submitted on Form 1023-EZ from $400 to $275 for applications submitted on or after July 1, 2016. Rev. Proc. 2016-32.

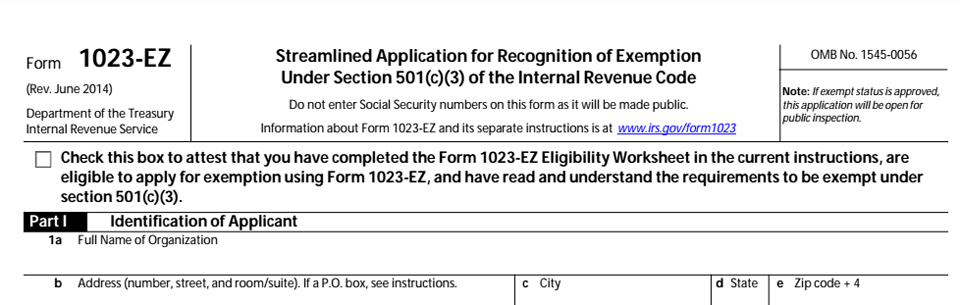

Organizations seeking recognition of exemption under Code Sec. 501(c)(3) generally must file Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, with the appropriate office as designated by the IRS. Eligible organizations can use Form 1023-EZ, Streamlined Application for Recognition of Exemption under Section 501(c)(3) of the Internal Revenue Code, to apply for a determination letter on exempt status under Code Sec. 501(c)(3).

The procedures for using Form 1023-EZ to apply for exempt status under Code Sec. 501(c)(3) are set forth in Rev. Proc. 2016-5. Organizations meeting all three of the following criteria are generally eligible to use Form 1023-EZ:

(1) Organizations with projected annual gross receipts of $50,000 or less in the current taxable year and the next 2 years;

(2) Organizations with annual gross receipts of $50,000 or less in each of the past 3 years for which the organization was in existence; and

(3) Organizations with total assets the fair market value of which does not exceed $250,000.

The application for exempt status must include the correct user fee, as set out in Rev. Proc. 2016-8 (as modified by Rev. Proc. 2016-32).

For more info, contact:

Patti Arthur

Anderson & Hughes, P.C.